How much hot air?

Hydrogen tax credits highlight the challenges of climate policy without economy-wide climate regulation

The middle of 2023 saw a major lobbying campaign and policy debate play out in DC around implementation of a provision of the Inflation Reduction Act (IRA) providing tax credits for the production of hydrogen (Section 45V). Important precedent, hundreds of billions of dollars, and success of the provision in driving development of low-emitting hydrogen technology, hinged on obscure and highly technical details around exactly how companies are required to calculate the greenhouse gas emissions associated with their production. In late December, Treasury released its proposed guidance that strikes a careful balance between upholding defensible emissions-accounting rules and providing flexibility for new hydrogen production technologies.

The saga of the 45V credits, however, highlights the challenges of attempting to build major climate policy on emissions accounting rules developed for individual, project level analysis. The U.S., recognizing the serious threat posed by climate change, has ambitious emissions-reduction goals. Achieving these goals using any policy instrument - subsidies, taxes, or regulation - will generate large relative price changes between dirty and clean technologies, driving changes in production and consumption behavior across the economy. In the absence of economy-wide carbon pricing or regulation, these responses will act to undermine policy effectiveness and confound emissions reduction goals. We should take away two main lessons: design of major U.S. climate policy cannot rest on project-level lifecycle emissions accounting that omits partial and general equilibrium responses; and economy-wide carbon pricing or regulation directly addressing the unpriced externalities from greenhouse gas emissions is likely to be an essential complement to the technology-focused policies of the IRA.

Creating hydrogen requires significant energy: a lot of money and emissions hinge on how that gets counted

Under most models of a zero-emission energy system, hydrogen plays a critical role in lowering costs and enabling decarbonization of otherwise hard-to-decarbonize sectors. Currently used principally in steel and fertilizer production, most energy-system models anticipate a much larger role for hydrogen, including for forms of transport that are hard to electrify and for long-term energy storage. But hydrogen can only play this role if its creation – a very energy-intensive process – produces no greenhouse gas emissions. The dominant method of hydrogen production today starts with methane (a potent greenhouse gas) and generate significant emissions, meaning rapid scaling of new, low-emission production technologies is required if hydrogen is to play the role that energy system models imagine for it in a zero-carbon economy.

The 2022 Inflation Reduction Act, under Section 45V, includes large incentives for low-carbon hydrogen production. The tax credits become more generous as the production emissions of hydrogen decline. For production that emits essentially no greenhouse gas emissions, (and meets other wage and apprenticeship standards) the tax credit is worth three times more than the current market price of hydrogen. Credible modeling by the Electric Power Research Institute (EPRI) found that the generosity of this uncapped credit leads to widespread take-up, primarily through expansion of electrolysis, which involves using large amounts of electricity to split water into hydrogen and oxygen. Fiscal outlays for this section of the IRA alone are estimated at between $500 and 760 billion through 2040.

So why the big fuss over the I.R.S. rules for 45V from Treasury? The issue comes from how to determine what hydrogen– if any – is produced with low enough greenhouse gas emissions that it should qualify for the most generous tier of the IRA credits. Due to its huge electricity requirements, essentially all emissions from electrolysis come from electricity generation; only electrolytic hydrogen made using exclusively zero-carbon electricity sources is clean enough to qualify. But the current and near-future mix of generation on the grid contains enough fossil fuels that basic, grid-powered electrolysis generates two times more greenhouse gases per kg of hydrogen than existing methods. Because the electricity requirement for hydrogen is so large, and the 45V tax credits so lucrative, electrolysis, and the rules under which it is allowed to grow, could have a substantial impact on the evolution of the US power sector - any by extension US greenhouse gas emissions - over the next 20 years.

The rules under which hydrogen producers should be able to legally claim that their electricity comes from clean sources are the key issue driving the 45V lobbying frenzy. In reality, the electric grid functions as a single, interconnected network, with aggregate generation meeting aggregate demand: electrons are identical and there is no way to assign particular electricity to particular end-uses. However, a system of “Energy Attribute Certificates” (EACs) has developed that allows consumers with particular interests (utilities trying to meet renewable generation regulation, companies with sustainability goals, or hydrogen producers claiming the 45V tax credit) to lay claim to certain types of generation, essentially reshuffling electricity generation between consumers that do and don’t care about the greenhouse gas emissions from generation. Although widely used to support corporate sustainability claims, evidence suggests that these claims are dubious and that the net effect of EAC purchases on system-wide emissions is minimal. As the first legal Federal statement on this issue, Treasury’s decision could well establish a standard for emissions accounting for electricity use in general – with potential applications for electric cars and appliances and private sector disclosure requirements in the future.

The proposed rules were released by Treasury in late December. In developing the rules, Treasury successfully navigated complex tradeoffs between supporting the development of a clean energy technology that many see as critical to full decarbonization and establishing important restrictions on the use of EACs to support legally-enforceable zero-carbon claims. The proposed rules allow use of EACs for 45V compliance, but establishes three restrictions that ensures the zero-carbon generation closely matches the location and timing of electrolyzer demand. Specifically, the rules require EACs to 1) come from generation in regions connected by transmission to the electrolyzer (deliverability); 2) to match demand and generation on an hourly basis rather than being able to average over longer time periods (hourly matching) and 3) to come from newly-build renewable generation rather than relying on existing zero-carbon capacity (new source). These guardrails are essential for the 45V spending to have any effect on lowering greenhouse gas emissions: EPRI’s modeling shows that relaxing any of the three would mean that the hundreds of billions in 45V spending would increase greenhouse gas emissions, simply from the large increases in electricity demand due to electrolysis. It is critical that Treasury maintain these standards in the finalized guidance, maintaining its position under what is sure to be a barrage of comments aimed at weakening the standards to generate industry profits at taxpayer expense for little to no environmental gain.

Lifecycle emissions accounting does not account for the partial and general equilibrium effects of ambitious climate policy

The 45V accounting saga is just the latest in a series of examples highlighting the challenges and potential pitfalls of building major climate policy on product-level lifecycle emissions accounting standards. Lifecycle analysis (LCA) is a set of technical accounting standards based on engineering data tracking the environmental effects of production and consumption. It is a method designed to enable small actors – individual or companies – to understand the environmental effects of their actions and support evaluation of changes to lower those impacts. If you’ve ever calculated your own personal carbon footprint, you’ve used a version of LCA.

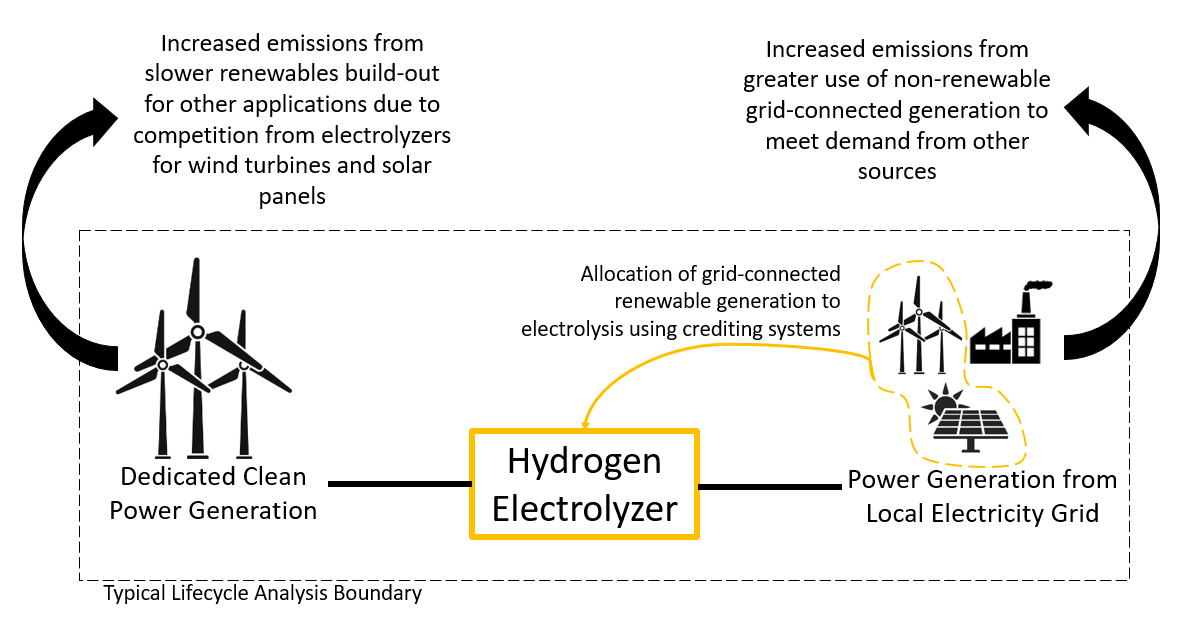

Applied to major regulatory or spending policies like the IRA, however, the weaknesses of LCA start to become apparent. Major policies that change the behavior of many actors produce consequences different than the sum of the parts. Because of the interconnected nature of the electricity grid, the energy system, and the global economy, major climate policy in the U.S. will alter equilibrium prices and quantities in ways that affect emissions outside of standard LCA accounting boundaries. Figure 1 shows two examples of how market interactions induced by the large incentives provided by 45V increase emissions in ways not captured in standard LCA accounting frameworks. These market interactions and associated responses by other market actors are accounted for in standard economic analyses (for instance general or even partial equilibrium modeling) but tend to be excluded by construction from LCA. The more comprehensive and more ambitious the climate policy, the larger the wedge is likely to be between an LCA-based emissions assessment and an economic assessment accounting for adjustment in prices, supply, and demand across multiple sectors.

The 45V case is just the latest in a series of cautionary tales where market-mediated responses undermine emissions reduction estimates based on bottom-up, engineering estimates from LCA. Most notably the U.S. Renewable Fuel Standard both requires and subsidizes the blending of biofuels into transportation fuels to reduce emissions. Eligible fuels must reduce emissions by a threshold amount relative to gasoline over their lifecycle. Although process emissions from a small amount of corn ethanol production may meet this threshold, the aggregate effect of diverting a large fraction of global corn production into gas tanks (40% of the US corn crop, the largest in the world, is used for ethanol) raised food prices causing an expansion of agricultural land both domestically and internationally, that likely eliminated any climate benefits from the law. The Administration is currently deciding on whether to double down on these issues by classifying ethanol as a “sustainable aviation fuel”, eligible for additional tax credits under the IRA.

Similar effects arise in carbon offset markets, where crediting is based on technical assessments of project-level emissions reductions, ignoring market-mediated responses that can undermine estimated emissions reductions. In one particularly perverse example, crediting for highly-potent greenhouse gases under the Kyoto Protocol led to expansion of production generating the gases, just so companies could generate highly lucrative credits from capturing them as “waste” products. Similar, less egregious, examples of questionable carbon accounting have been documented in forest offset projects and renewables projects in lower-income countries.

Even for 45V, lurking issues remain regarding the appropriate crediting – if any – of methane capture from dairies for standard hydrogen production methods using methane reforming. If certain methane capture projects are credited in similar ways to their treatment under the California Low Carbon Fuel Standard, the 45V provision could end up providing heavy subsidies to incumbent producers at the expense of new, low-carbon production technologies the law is clearly intended to promote. The fact that the success of this IRA provision - and up to $750 billion in taxpayer spending - hinges on such arcane and highly technical questions is a perfect illustration of the challenges involved in trying to build national climate policy on technical lifecycle accounting standards developed for analyzing individual projects.

Economy-wide carbon pricing will be an essential complement to existing climate policy

The U.S. has ambitious climate commitments of reducing emissions 50-52% below 2005 levels by 2030 and reaching net-zero emissions by 2050. Achieving these goals will require a complete transformation of the energy sector in the world’s largest economy. Any policy instruments used to achieve this transformation – whether regulation, subsidies, or explicit pricing - will, by necessity, generate large relative price changes in the energy sector and, depending on offset and biofuel provisions, in the agricultural sector as well. Economic actors across globally interconnected markets will reasonably respond to these shifting incentives in ways that minimize costs and maximize profits. In the absence of carbon pricing, these responses will more often than not work to undermine U.S. climate goals.

The challenge of attempting to manage this transition exclusively through technology-specific subsidies and regulation cannot be overestimated. Policymakers and regulators are required to anticipate effects of their actions in a rapidly changing techno-economic landscape, with complex interactions across policy domains and economic sectors, at an informational disadvantage relative to interested private sector actors.

The benefits of even a modest carbon price or cap as a complement to existing policy instruments are already high and will only grow as climate policies ramp up in ambition and scale. Carbon pricing helps to align incentives of actors across the economy, directing market responses toward supporting rather than undermining climate benefits. Economy-wide carbon pricing or an emissions cap reduces the risk of apparently minute technical changes in regulation completely altering climate outcomes. The European experience is a case in point. While Treasury was developing 45V standards, Europe was also working on its emissions accounting standards for electrolytic hydrogen. But because of its cap on electricity sector emissions, the potential for perverse outcomes was far lower: higher electricity demand from electrolyzers will raise the price of European emissions credits, driving cuts in emissions in other parts of the economy.

The case that solving the climate problem requires addressing more than one market failure, and that sector-specific policies addressing network and technological externalities are essential, has been well established. U.S. net-zero goals will not be achieved by carbon pricing alone. But the climate problem is still essentially one of a global, unpriced, environmental externality. In the absence of policies to internalize that externality, market responses will continue to work against climate goals, raising the cost and decreasing the effectiveness of emissions reduction policies.