How Big Is the Subscription Cancellation Problem?

We signed up for and canceled subscriptions to 47 newspapers to find out

We’ve all had bad experiences canceling subscriptions. Fortunately, the Federal Trade Commission (FTC) is doing something about it by finalizing a rule that will require companies to make canceling subscriptions as easy as signing up. But how big is the problem of companies bogging down the cancellation process — and who are the worst offenders?

Months before the FTC rule finalization, we embarked on an investigation to find out, signing up for and canceling subscriptions to 47 of the most widely circulated newspapers in the country. We subscribed and canceled from Massachusetts, where there are no state laws covering subscriptions, and from California, where a state law requires that companies allow customers to cancel online without additional steps that create obstruction or delay.

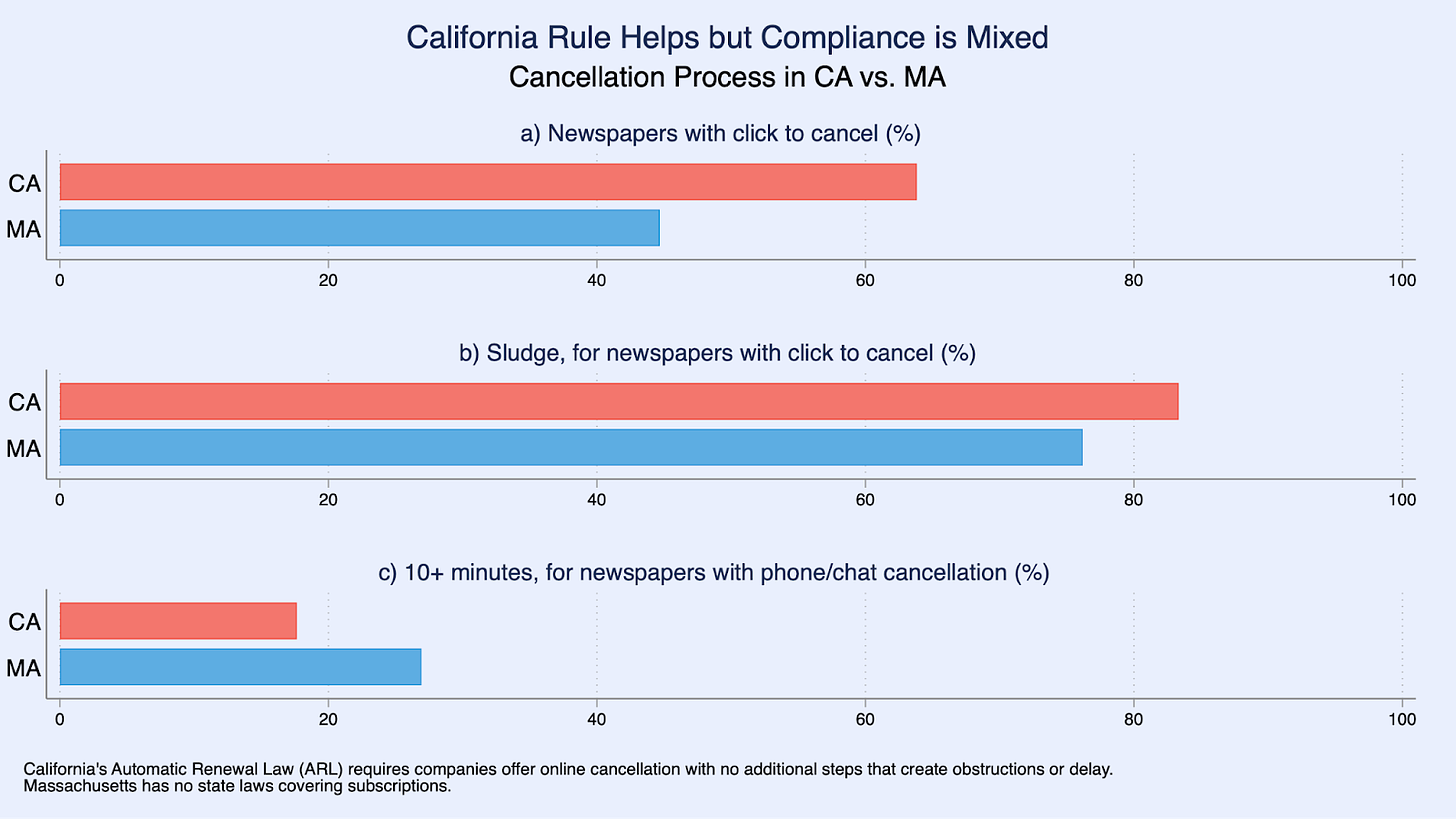

While every single newspaper allowed online signup, only 45% allowed Massachusetts consumers to click to cancel. Moreover, of the newspapers where online cancellation was possible, 76% bogged down the process with sludge: required surveys asking for the reasons for cancellation and promotional offers that needed to be clicked through to reach the cancellation page. California subscribers had a better — but far from ideal — experience, with 64% of newspapers allowing consumers to click to cancel. That said, 83% of these newspapers still added sludge to the online cancellation process.

The results suggest there is substantial room for improvement that can be addressed by the FTC click-to-cancel rule. However, the evidence from California — where many newspapers are in possible violation of state law by not allowing easy online cancellation or by injecting sludge into the process — indicates that enforcement will be necessary for the FTC rule to achieve its intended effect.

Less than half of newspapers allowed Massachusetts subscribers to click to cancel, and almost all injected sludge into the cancellation process

We collected data on 47 of the highest circulation newspapers in the United States using a billing and IP address in Massachusetts, where there are no state laws covering cancellations, and a billing and IP address in California, where state law requires online cancellation without obstruction or delay.1

We signed up for the cheapest digital automatically renewing subscription when multiple options were available and then recorded our cancellation attempts. For each newspaper, we searched for a button or link that would allow us to “click to cancel” the subscription. If there was no button, we tried to cancel via the most prominent option. This was nearly always by phone, but in a few cases, online chat or email. The signups and cancellations were conducted between September 2023 and December 2023.

Exhibit 1 breaks down the cancellation process for Massachusetts subscribers (no state laws covering cancellations). While every single newspaper allowed us to sign up online, only 21 of 47 allowed us to click to cancel. Of the newspapers that allowed us to click to cancel, 76% injected sludge into the process, defined as at least one additional step that unnecessarily obstructed or delayed cancellation. Specifically, 67% required us to fill out a survey with the reasons for cancellation, 24% required us to click through promotional offers, and 15% required both.

For the remaining 26 newspapers, we had to cancel by phone (or in 2 cases by online chat or email). Canceling by phone required calling during business hours, often waiting to be connected with a representative, and then typically enduring delays while the representative looked up our account and pitched promotional offers. Ultimately, having called during business hours, we were able to cancel 19 of these subscriptions within 10 minutes, with 7 taking 10 minutes or more.

We had a number of especially frustrating experiences. The Honolulu Star-Advertiser transferred us to the cancellation department, where we were put on indefinite hold. We went through this process multiple times before eventually canceling via a back-and-forth email thread. The Chicago Tribune online platform manager was down for over a month, preventing us from canceling online. We could not connect with the Albuquerque Journal online chat despite contacting them during business hours; we eventually were able to cancel by phone.

California’s online cancellation rule helps but compliance is mixed

In recent years, a handful of states have passed laws to address this issue. The provisions of these laws range from lighter-touch disclosure requirements to stronger requirements that companies periodically remind customers about automatic subscriptions and allow online cancellation without obstruction or delay. Exhibit 2 shows that 3 states – California, Colorado, and Minnesota – have enacted the strongest set of consumer protections, including click-to-cancel requirements (with Minnesota’s law taking effect on January 1, 2025). A further 9 states have a partial set of provisions, typically related to disclosure and notification. Hover over the map for the details.

Exhibit 2: State laws on subscriptions

To assess the impact of state laws, we signed up for and canceled subscriptions at the same 47 newspapers using a billing and IP address in California, which has the strongest laws on the books. Specifically, for consumers who signed up online (which we did), the law requires that companies allow customers to cancel online without additional steps that create obstruction or delay (or with a single pre-formatted email).

Exhibit 3 shows our cancellation experience when subscribing from California compared to Massachusetts. California subscribers can click to cancel 64% of their subscriptions, substantially higher than the 45% for Massachusetts subscribers. Still, 17 of 47 newspapers did not allow us to click to cancel, in possible violation of the law that requires online cancellation with a “prominently located direct link or button” (CA Bus & Prof Code § 17602(d)(1)(A)).

Further, among the 30 newspapers that allowed us to click to cancel, the vast majority injected sludge into the process, also in apparent violation of the law’s restriction against adding “further steps that obstruct or delay the consumer’s ability to terminate the automatic renewal or continuous service immediately” (CA Bus & Prof Code § 17602(d)(1)). For instance, 21 newspapers required us to fill out a survey with reasons for cancellation, 14 required us to click through promotional offers, and 10 required both of these additional steps.

The California-based newspapers were not markedly better. Even with a California account, we were unable to click to cancel 2 of the 7 California-based newspapers (Orange County Register, Sacramento Bee). Of the 5 where we could cancel by clicking, 3 injected sludge into the process (East Bay Times, Mercury News, SF Chronicle).

We also had some noteworthy bad experiences canceling from California. Canceling our Buffalo News subscription took multiple back-and-forth emails over 24 days. As mentioned above, the Chicago Tribune online platform was down for over a month, preventing us from canceling online. We had to wait 15 minutes for an online chat response from the Kansas City Star, only to be told to contact them again during business hours (it was 3 pm central time on a Wednesday), and so we resorted to canceling by phone. It took us 30 minutes to cancel our Sacramento Bee subscription and 50 minutes to cancel our Miami Herald subscription via online chat. The Raleigh News & Observer transferred us to multiple departments that pitched us discount offers before finally letting us cancel.

In the subscription economy, there are subscriptions to manage your subscriptions

In recent years, we’ve seen a boom in the “subscription economy.” While some products have long been purchased as subscriptions (newspapers), today, we purchase everything from music (Spotify, Apple Music) to movies (Netflix, Hulu) to beauty products (Ipsy) to dinners (HelloFresh) via recurring subscriptions. Indeed, a consulting firm estimated that the subscription economy has grown by more than 400% over the past decade.

Many consumers are aware that they struggle to track and cancel unwanted subscriptions. Millennial readers may remember the episode of Friends where Chandler tries in vain to quit the gym, lamenting, “They’ll take $50 a month from our accounts for the rest of our lives”. Others may remember the infuriating practice during the COVID-19 pandemic of gyms requiring in-person cancellation exactly when people wanted to avoid in-person interactions due to transmission risk. The Rocket Money and Bobby apps offer to help consumers find and cancel subscriptions they no longer want. The payment model for these services? You guessed it: a subscription.

Academic research shows how cancellation issues boost company revenues

Researchers are documenting cancellation difficulties and investigating their implications for consumers and businesses. In a related study, Sheil, Acar, Schraffenberger, Gellert, and Maloney signed up for and canceled newspaper subscriptions from locations in the United States (CA and TX) and 3 European countries (Germany, Netherlands, United Kingdom). They find that cancellation is generally easier in Europe, consistent with Europe’s stronger consumer protection laws.

Liran Einav, Ben Klopack, and Neale Mahoney (a coauthor of this post) estimate how much extra businesses earn from consumers paying for subscriptions they no longer want (because they forgot or find it difficult to cancel). They document a sharp drop in subscription retention around card replacement (e.g., due to expiration) when consumers have to update their card numbers and thus have to make an active renewal choice. Interpreting this drop through the lens of a simple model, they estimate that consumers' failure to cancel subscriptions they don’t want boosts subscription company revenues by 87% relative to what it would be if consumers faced no cancellation issues.

Of course, especially sophisticated consumers may anticipate their future cancellation issues, and adjust their behavior accordingly. Indeed, in an experiment with a European newspaper, Miller, Sahni, and Strulov-Shlain show that some consumers choose not to sign up for a promotional offer when it will auto-renew at full price rather than ending after the promotional period.

The FTC rule will save consumers money and improve market functioning

Consumers are better off when they can easily track and cancel subscriptions that do not provide them value for money. Markets also benefit, as more active consumer behavior prompts companies to improve the quality and reduce the price of their offerings.

The FTC is finalizing a click-to-cancel rule that requires companies to make it as easy to cancel as it was to sign up. For digital subscriptions, which are easy to forget about, the rule would require companies to send consumers an annual notice about ongoing subscriptions. Last month, the White House announced the Federal Communications Commission (FCC) would be considering a similar rule for companies in the communications industry.

The FTC rule is an important step that should save consumers time and money. To protect consumers and improve market functioning, policymakers could consider additional actions, including those that may require new legislation.

One idea is to promote the creation of simple online interfaces where consumers can easily track and cancel all of their subscriptions. iPhone users may be familiar with the subscriptions page (Settings > Your name > Subscriptions), where they can view and cancel App Store subscriptions in a few seconds. To improve market functioning, policymakers could have the government build a similar “subscription dashboard” or facilitate its creation by third parties.

Another idea is to require occasional active renewal so consumers do not end up paying for subscriptions they do not want indefinitely. For example, the study mentioned above found that requiring consumers to actively renew every six months would slash companies' excess revenue in half. Companies that are able to track usage could require active renewal if the consumer has been inactive for an extended time period. For instance, Netflix could send an email prompting an active renewal decision if the consumer had not viewed content in the last 3 months.

Markets function better when consumers can easily cancel subscriptions they no longer want. Our experience signing up for and canceling 47 newspaper subscriptions indicates that cancellation is often far more difficult than it needs to be. The FTC click-to-cancel rule is an important step and should be coupled with strong enforcement to achieve its intended effects, and policymakers should consider further actions to protect consumers and enhance market functioning.

Appendix

We started with a list of the 50 highest subscription U.S. newspapers from the Alliance for Audited Media, and excluded 3 newspapers that either did not offer a recurring subscription (Chicago Sun-Times, NYPost) or did not load properly when we attempted to subscribe (Star Tribune).